In this article, the fourth of a seven-part series, I'm going to explain the importance of website traffic, how it's measured, how it can be managed, and its development motivated. For small business owners, just like winning a new customer is hard work, so is developing web traffic. Unfortunately, there's been little understanding or vision within the office products industry that, by working to fix the web traffic issue, it may in fact subsequently become easier to win new customers!

The Series Index & Links to Access

- Part I - Domain Age and Authority

- Part II - Website Grade

- Part III - Backlinks

- Part IV - Traffic Ranking

- Part V - Social Shares

- Part VI - Social Authority

- Part VII - Conclusions

I'll be publishing the final three parts to this series over the next ten days or so with a view to more fully supporting the argument I presented in my article, "How the Office Products Industry has Failed the Resellers".

The Importance of web traffic:

As this series of articles has been prepared to explain, there are many digital components that need to be in place and in order, before serious web traffic development can effectively commence.

- World-class website with frequent updates

- High-quality, relevant content

- Social Media audience development and engagement

- Inbound marketing (social and email)

My sense is that many small business owners don't know where to start, either with the foundational components listed above or with the subsequent strategies for developing traffic. Although almost all of the reseller businesses have websites, I've have heard more times than I can recall that, "My website is there for a different reason, my customers don't need me to have a website", that I, in turn, have interpreted as another way of saying "I've got a website but I really don't know what to do next!"

This kind of reseller thinking defies logic. Why bother with a website at all if there's no plan or objective to develop traffic. It's like setting up a conventional brick and mortar store in a remote, isolated location, which everyone instinctively knows would be a waste of time and money, but, for some reason not having a similar, intuitive understanding, that a web site isolated in the remote depths of the internet is also a complete waste of time and money.

"Money has been invested to build websites, but money has not been invested to develop traffic to them. Oftentimes the site investment will now turn out to have been a waste, because the structure and design wasn't suitable for traffic development in the first place."

According to the 2014 State of B2B Procurement study from Accenture's Acquity Group, 94 percent of business buyers do some form of online research before making a buying decision.

- 77% use Google Search

- 84% check business websites

- 34% visit third-party websites

- 41% read user reviews

"For office products resellers, who have failed to deploy websites designed to satisfy the requirements of the 94% of B2B buyers who conduct online research before making a buying decision, these statistics should send a deep chill down their collective spines!"

Office products resellers must understand that over 90% of their potential customers, and perhaps just as important, their existing customers, are researching online. Once this fact, and its implications are understood, then content relevant to these searches must be created and placed on their websites in an effort to become a source of authoritative information that's responsive to these searches. If this can be achieved, then the foundation for developing traffic has been established.

How to measure web traffic:

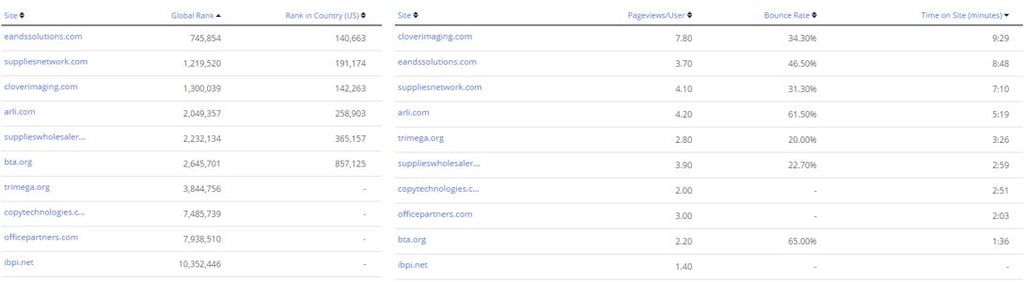

Most are probably familiar with Google Analytics and perhaps, somewhat less, with the Alexa analytics service provided by Amazon. In order for the analytics to be accurate, both services require tracking code to be installed on the owner's website. Once this has been done, then detailed metrics regarding all aspects of the traffic to the site are available, such as the sample set shown in the table below.

| Metrics | Actual | Budget | % of Budget |

| Unique Visits | 3,049 | 4,000 | 76% |

| Total Visits (includes returning visitors) | 4,457 | 6,000 | 74% |

| Page Views | 8,167 | 12,000 | 68% |

| Search Engine Referrals | 186 | 500 | 37% |

| Social Referrals | 440 | 800 | 55% |

| Visits from Links | 493 | 600 | 82% |

| Direct Traffic | 4,535 | 4,000 | 113% |

| Bounce Rate | 46.5% | 30% | 65% |

| Page Views per Visit | 1.83 | 2.00 | 92% |

| Minutes per Visit | 8.48 | 4.00 | 212% |

| Total Time on Site (hours) | 629.92 | 400.00 | 157% |

| Visits from Mobile | 896 | 1,000 | 90% |

| Global Rank (Google = #1) | 698,392 | 500,000 | 71% |

| USA Rank (Google = #1) | 140,663 | 120,000 | 86% |

How to manage and motivate web traffic development:

A major part of the answer to the management and motivation for ongoing traffic development is the preparation of a budget and then closely monitoring ongoing performance compared to that budget. Small businesses often neglect to prepare traditional budgets for sales, operating expenses, profits, etc. and it's doubtful many have ever even thought about preparing a budget for the key performance indicators associated with web traffic development and visitor engagement. However, web traffic is not a passive thing that just happens, it's hard work and, to stay motivated and keep doing the work day after day, you need to see the results of your efforts as they're tracked against realistic goals. Otherwise, and I've seen it many times, the initial effort quickly winds down and is eventually abandoned.

"I know first-hand it's hard work, the numbers in the data table are our numbers!"

We registered this domain for Executive & Strategic Solutions in January 2015 and launched the site with basic content a few months later. I started my blog in September 2015 and we did a major upgrade of the site in mid-2016. We've worked hard on the content and on our efforts to develop an audience. We still have a long way to go but, in a sad reflection of the industry, these numbers are already significantly better than the individual performance of most of the businesses that make up a $5 billion aftermarket office supplies industry in the United States. We've been going for barely two years while the industry's average domain age is over 15 years. I'm not bragging here, as our intent in disclosing these metrics is not to "toot our own horn", it's to expose the terribly weak performance of the industry as a whole.

Learn more about a unique Digital Transformation Service - everything you need for a digital upgrade and the tools needed for developing new business with "Blue Ocean" caliber customers. Just click on the link below.

Conclusions:

As we approach 2020, a viable business without a website is unthinkable and a website without traffic, or a strategy to develop traffic, is useless. The aftermarket office products industry as a whole must stop ignoring the traffic problem and start to deploy and execute strategies to address the issue.

Perhaps I'm beating a dead horse but, when over 90% of buyers are researching online before making a buying decision and, with as many as 5,000 independent resellers in the United States failing to build effective landing pages for these searches, then why should we be surprised the aftermarket share has been static for a decade and, unless something changes, is now poised over the next decade, for the double-whammy of losing market share in a now shrinking market.

If you missed my eight-part series on the office supplies aftermarket tipping point, please check out my new eBook, it's just published, it's FREE, and it contains a thorough examination of the office supplies industry and a path to the $20 billion growth opportunity for independent resellers.