Our financial projections model for the office products and equipment industry is built on a number of assumptions designed to account for the overall market decline, the impact of a change in mix between monochrome and color printing, the impact of price changes, and the net rate of customer churn (loss).

The assumption we've used for the past 2-3 years for the rate of market decline has been a fairly modest 4% per year on monochrome printing, and 1% on color. All other reseller revenue generators, such as equipment, furniture, and general office products, have been (and continue to be) assumed to decline at around 5% per year.

However, some of the numbers recently showing up in financial performance and print data suggest our assumption on the rate of decline in printed pages is too low, and it's more likely to already be closer to 10% per year.

- Print Audit 2015-16 Industry Printing Statistics

- Essendant Financial Performance

- SP Richards Financial Performance

- Office Depot Q3 2017 Results

- Staples Privatization

- Clover Imaging Group

What's the underlying cause of the accelerating decline in transactional demand for office products and equipment?

With less than 5% of the U.S. workforce currently out of work, it's not like the economy is mired in a recession!

We've been listening to predictions for the imminent arrival of the paperless office for more than 30 years now, but, it does finally appear wide scale improvements in efficiency are taking place that have a dramatic impact on the need for paper in the office.

Implementation of software designed to help improve processes, to store and quickly retrieve electronic documents, to monitor networks for advance signs of potential breakdown, to identify equipment most suited to the customer needs, and manage the total cost of ownership, are all gaining traction. These appear to have become the key factors that underlay the increased decline in transactional office product sales.

| Example A | Example B | |

| Revenue | $5.0M | $5.0M |

| Ink & Toner (% of Total Sales) | 25% | 25% |

| OEM Ink & Toner (% of Total Ink & Toner Sales) | 70% | 70% |

| Mono Cartridges Market Shrink | -4% | -8 to -11% |

| Color Cartridges Market Shrink | -1% | -4 to -7% |

| Aftermarket Cartridges Price Change per Year | -3% | -3% |

| OEM Price Change per Year | +1% | +1% |

| Other Office Products Market Shrink | -5% | -5% |

| Revenue +4 years (Before Churn) | $4.29M | $3.94M |

| Churn (Customer Loss) | 10% | 10% |

| New Customer Acquisition | 4% | 4% |

| Net Churn | 6% | 6% |

| Revenue Projection after Churn | $3.36M | $3.08M |

| Percent Revenue Loss over 4 years | -33% | -38% |

What we see from the two examples illustrated in the data table above, is an additional loss of 5% on the top line over a four-year period resulting from, what we now believe to be, more realistic market shrink rates on ink and toner compared to the assumptions we've historically used.

The profile in these examples is based on an office products and business equipment reseller with 25% of its total sales on ink and toner, and 70% of these sales on OEM brand cartridges where, a 1% projected annual increase in prices, somewhat mitigate the impact of market shrink.

Resellers with a higher concentration of their total sales in ink and toner, and a higher percentage in aftermarket products, will be likely to experience even steeper revenue losses.

Bottom line, our model is focused on the transactional environment which is precisely where the biggest problems for resellers lie.

To access our business projection modeling platform please click the link below.

Historically, Office Depot has been a transactional reseller through both of its retail and B2B channels. However, to mitigate the free-fall in its transactional business, they must implement a "stickier" software solutions sales model and transition their business to a services oriented bias.

Depot has acquired CompuCom, a services company, to enable them to transition from a transaction focused model to a services based model. Their survival is at stake!

While transactional sales in the office products vertical may be decreasing, many companies believe there's potential for sales growth on the services side. With this in mind, let's look a little closer at the Office Depot and CompuCom deal. Four key metrics were reported that help us understand the importance of this deal to Office Depot.

- $1.1 billion in sales

- 10 million devices monitored

- 5.15 million users

- 8 million Service Desk contacts

$1 billion in sales divided by 10 million devices equates to $100 per device per year.

Office Depot will be offering the CompuCom services into its existing customer base as fast as they possibly can because they must replace their declining transactional business with the service contract revenue they hope to earn from monitoring devices. If they're able to achieve this, they will reduce customer churn and they will stabilize, or even grow their top line.

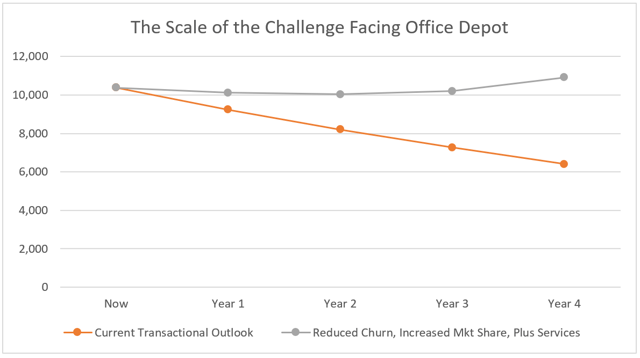

To illustrate how critical this is for Depot, after applying our updated model assumptions to their existing $10.4 billion business then, if nothing else were to change, we project a decrease to $6.4B in sales four years out from now.

So, to survive Depot must:

- Increase revenue from new product lines (services)

In replicating the CompuCom model to their existing customers, Depot must get 20 million devices under management within the next 4 years to generate an additional $2 billion in sales. However, to put such a goal into perspective, this is twice the current size of CompuCom's monitored device fleet!

- Reduce churn (services are a "stickier" sale)

The services model has the potential to result in a "stickier" sale that will reduce churn rates.

- Increase market share (traditional products)

Office Depot will cross-sell its traditional line of office products to the CompuCom customer base. This will be how Depot seeks to increase market share in the declining office products market.

The chart above illustrates the scale of the challenge facing Office Depot and, to achieve results of this order, they must:

- Get 20 million devices under management each generating $100 of service revenue per year

- Reduce net churn from 6% to 1%

- Increase market share on traditional office products

We've been saying for many months that the threat from Amazon is finally waking up its competitors and forcing them to upgrade their capabilities to slow down their churn (customer loss) rates. However, as competitors, such as Best Buy, Walmart, Target, etc. all start to see signs of success with their initiatives to improve their competitive capabilities, they also become a greater threat to the independent "analog" resellers stuck in their old-school, inefficient business ways. In other words, even if independents don't yet fully understand this, they already have a lot more to worry about than Amazon!

Office Depot is just one of Amazon's competitors facing serious threats to retain its retail and business (B2B) customers and the acquisition of CompuCom represents a recognition of this threat. However, independents must take note that, in responding to the Amazon threat, Depot is also positioning itself to make it much more difficult for anyone to take business away from in the future.

It will be much more difficult for independents to compete with Depot as "service" hooks are established with their customer base, similar to the ones CompuCom built its existing $1 billion business on.

In a declining office products market, the only way to increase the top line is from new product sales (i.e. services) and from increased market share. Also, if Office Depot is able to reduce churn, the other side of the equation is to lower their competitors customer acquisition rates as it becomes harder for them to increase market share at Depot's expense.

In previous publications we've explained our view of how vulnerable Depot and Staples have historically been to smart competition, and how independents should focus on competing for their business, rather than diving into the chaos of the Amazon marketplace.

However, and unfortunately for the independents, unless they improve their value proposition by starting to offer services similar to those that result from the Office Depot acquisition of CompuCom, they'll be finding it even more difficult than it has been in the past to win new customers. Instead, their former top prospects will be busy implementing programs offered by Depot designed to help them achieve substantial reductions in the cost of running their back office. The value proposition resulting from discounted aftermarket ink and toner in transactional deals is unlikely to be adequate in the longer term.

Furthermore, services applied on the scale of deployment Depot needs to grow its top line will accelerate the reduction in demand for traditional transactional office products, supplies, and equipment.

Unfortunately, most transactional office products and equipment resellers are not well-equipped to sell services. While the Managed Print resellers have developed service selling skills, the transactional Office Products resellers mostly have not. This puts the transactional reseller at a disadvantage.

Of course, Depot has historically been a transactional reseller and, as such, was never really able to get a service selling program, such as Managed Print, off the ground, just as Staples also mostly failed to do. However, with Depot acquiring the CompuCom service-selling expertise, if they're able to successfully leverage this into their currently transactional base, it could very well be a game-changer.

Conclusions:

While Staples has leveraged their balance sheet with the debt incurred to fund their privatization, Depot has leveraged some of theirs to fund a strategic acquisition that appears to give them a fighting chance. However, there are no guarantees of success and their ability to leverage the service selling skills acquired in the deal, and to implement them into an historically transaction based selling culture, is not a foregone conclusion.

Analysts questioned the strategy as it became public and Depot's share price came under increasing pressure, with many observers dubious the services initiative will be successful. However, in our view, the strategy is sound and alternatives limited but, nevertheless, to successfully execute a transformation of this magnitude will be a remarkable achievement and is an outcome that's by no means certain.

This is where independents may still have a fighting chance. Office Depot has a difficult task to turn its "Titanic" around. It won't be easy, it will take time, and there will probably be clashes of culture that slow the process down. Regardless, independent resellers must take careful note of the events unfolding here because the window of opportunity to implement counter measures necessary for their long-term future is rapidly closing.

As an office products & equipment reseller, are you still operating in the analog world or are you transitioning to digital with the use of sophisticated digital marketing tactics? You can't survive unless you do, so please check out our SlideShare "executive" summary to help you determine where you are in the process!

To improve the future for office supplies dealerships, their websites must become the foundation for digital transformation. As office product resellers or OE resellers, why not check out our free, no obligation, offer for a comprehensive evaluation of your site? Just click the button below.