With the emergence of the Chinese aftermarket ink and toner manufacturing superpowers, I anticipate new battles for market share will take place between the OEM and aftermarket brands. In this, the seventh part of the current series of blogs, I'm going to explore where these battles are most likely to take place. In previous posts in this series I've already explained the aftermarket tipping point, explored scenarios for the OEM and aftermarket manufacturer merger endgames, the reseller merger endgame, and the consumer adoption curve as it relates to aftermarket ink and toner. The scene is now set to explore possibilities for market share development.

The Aftermarket, Office Supplies, and a Major Tipping Point Series

The Aftermarket Manufacturer's Endgame (Part III)

The Reseller's Endgame (Part IV)

Summary - The Mergers Endgame (Part V)

The Consumer Product Adoption Stages (Part VI)

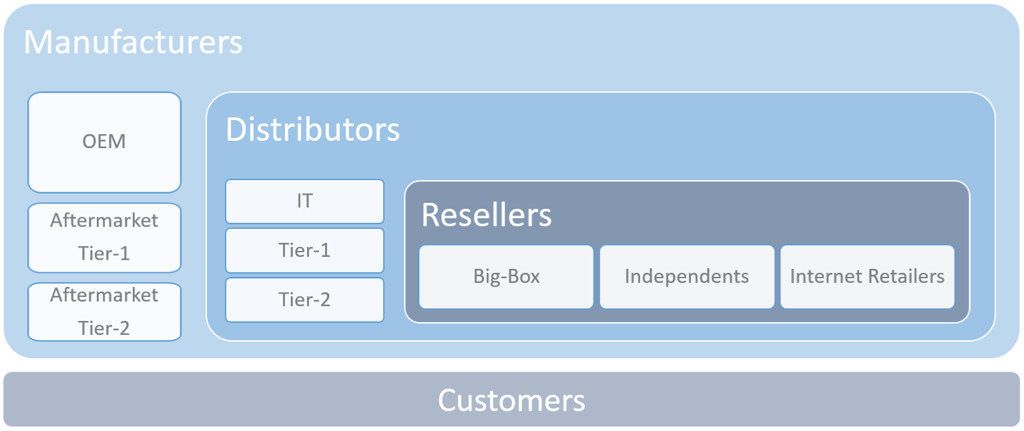

Directly below is a graphic illustrating how office products get to market in North America. I already explained (in Part VI) how the OEM's, leveraging their power over the distribution channels, effectively control market share between the original and aftermarket products.

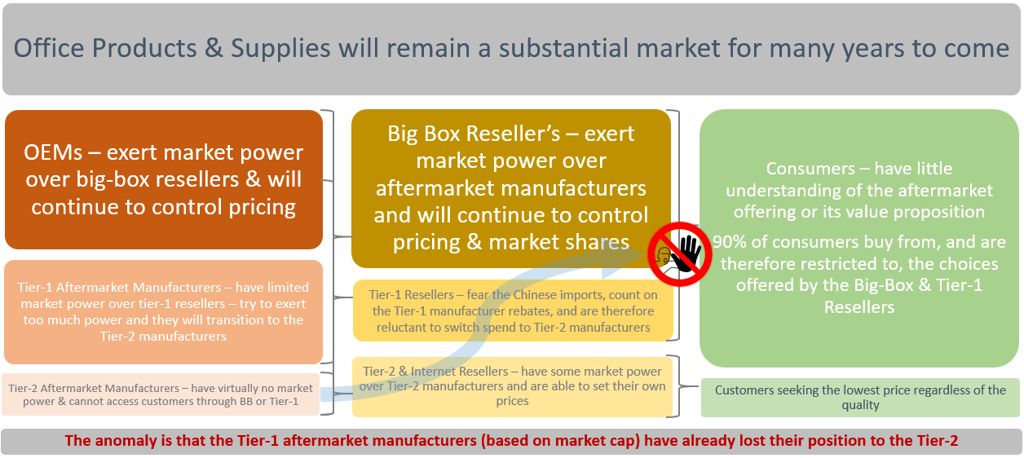

Now take a look at the second graphic below illustrating how, the 90% of consumers buying office products, choose to do so from the Big-Box and Tier-1 resellers and, consequently, only have access to the products offered by the OEM's and Tier-1 aftermarket manufacturers. Remember also, my explanation in Part VI with regards to how the OEM's control their market pricing and market shares through the rebate programs and other carefully deployed aftermarket blocking tactics.

There's no way for the Tier-2 [Chinese] aftermarket manufacturers to access the 90% of consumers who currently choose to purchase through the Big-Box and Tier-1 resellers because these resellers elect not to place the Tier-2 products into distribution for their customers to select from.

The OEM's, big-box and Tier-1 resellers have effectively organized themselves (or been organized) into a cartel, and there's no way for market shares to substantially change unless this cartel arrangement is breached.

Note my comment at the foot of the graphic that the small group which makes up, what I've termed "the Tier-1 aftermarket manufacturers" (Clover Imaging Group, LMI Solutions, and Turbon) have, in fact, already effectively lost their Tier-1 status to the emerging Chinese superpowers. The Chinese aftermarket manufacturers have cost, capital and product (new-build) advantages and therefore, over time, have the power to breach the cartel that currently controls pricing and market shares.

Here are four scenarios that could potentially develop from these circumstances:

1. The OEM's eliminate the Chinese threat

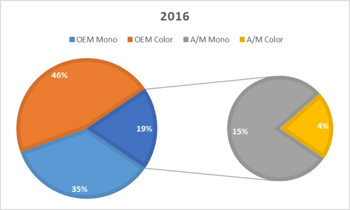

The OEM's surely recognize the emergence of the Chinese superpowers and the threat they pose to their business model. Of course, they want things to remain as they currently are, with an ongoing and steady decline of the aftermarket share due to shrink in the monochrome market and with their continued success preventing the aftermarket from breaking into the color market.

How better to achieve this, and simply neutralize the Chinese threat in the process, than by encouraging the big-box and Tier-1 resellers to transition from their current suppliers (Clover and Turbon) over to the Chinese? Remember, the OEM's control both pricing and market shares and, so long as the current cartel structure is preserved, they can ensure there will be no change to the pricing model or to the overall trend in market shares.

In this scenario, the cartel could be preserved, and the Chinese simultaneously neutralized, simply by encouraging the Tier-1 reseller's to replace their current suppliers. In doing so they'll probably get lower prices than they currently do from Clover, LMI, and Turbon, increasing their already substantial margins on aftermarket products in the process.

Don't forget, the OEM's could also choose to buy compatibles directly from the Chinese in order to support their MPS contracts, just like they've already done with Clover and LMI. In doing so, they'd further neutralize the Chinese and make it less likely they'd go down a path to support resellers outside the cartel and attempt to build market share at the expense of the OEM's.

Development of this scenario would provide a big boost to market share for the Chinese and a big loss to the current suppliers. However, so far as the OEM's are concerned, it's just a pocket shift and overall they could achieve their goal of keeping things the way they are. The cartel would be preserved - just one group of members would be changed from the current incumbents to a new group of [Chinese] members.

Of course, Clover, LMI, and Turbon aren't going to roll over and let this happen without a fight. They provide a lot of services to the big-box resellers and Tier-1 dealers that the Chinese would struggle to replicate so, it would be a disruptive change requiring significant adjustments by the resellers in order to try and make it work. Perhaps the OEM's increase their rebates by a point or two for a few months to help pay for the transition - who knows?

Scenario Conclusion:

The OEM's are clever, very clever. They know how to play this game so don't be surprised if some variation of this scenario plays out. Furthermore, it's not like they must do all or nothing - they may start off with small, seemingly innocuous moves that we may not even hear about, and then more aggressively when necessary. I rate the chances of the OEM’s playing a leading role in the Chinese increasing their share at the expense of the existing players at a modest, 2 out of 5.

2. Amazon figures out the B2B Channel

All the aftermarket manufacturers (Chinese as well as domestic) are already selling on Amazon, both directly and indirectly. So far, only a relatively small segment of consumers (mainly B2C) have chosen to buy their ink and toner cartridges from this channel.

What if Amazon decides to step deeper into the fray? We know they'd like more of the action in the office products vertical - we just don't know how much they want it!

We know they've captured consumers (mainly B2C) of office products through their marketplace, and we know they have a decent understanding of the market. We know they'd like the B2B business and we know they've re-vamped their Business Service Division in order to try and win more of this business.

We also know Walmart is making a big push into e-commerce and we've recently heard analysts speculating about the potential advantages they may develop over Amazon if they're able to leverage their 5,000 stores as distribution and pick-up centers - just as Best Buy has been successfully doing over the last couple of years.

What if Amazon also views Walmart's strategies as a potential threat and decided to snap-up OfficeDepot to counter them? Not only a massive step up for them in terms of the B2B contract stationary business but also 1,400 retail locations that could counter potential advantages Walmart may be able to develop. Furthermore, what could Amazon stock those OfficeDepot retail locations with, in the future besides office products?

Scenario Conclusion:

Amazon has a lot going on and it would be enormously risky for them to take on a brick and mortar retailer such as OfficeDepot and to integrate it into its existing business. Furthermore, even if they did, then in order to improve the overall OfficeDepot business model, they'd face the same issues I'm going to explain in the following "break-rank" scenario. Bottom line, why would Amazon contemplate buying OfficeDepot if the constraints to improve its business model (i.e. aftermarket cartridges) involved putting the business they had acquired at risk? Overall, I rate the chances of this scenario playing out at a slim 0.5 out of 5.

3. A Big-Box Retailer breaks ranks

After the Staples deal to acquire OfficeDepot failed, Depot has come out of the mess with all guns firing. They appear to have a plan and are taking decisive action. Their CEO, Roland Smith, declared back on May 16th, 2016, when the deal finally collapsed, that the company's future would depend on "bold new action".

Well, what if they decided to take bold new action, unilaterally exited the cartel, and gave more prominence to aftermarket cartridges? Remember the gross margins on OEM sales (after factoring in rebates) are 10-15% whereas they're 65%+ on aftermarket cartridges - potentially even more if they were sourced directly from the Chinese.

| OEM | Aftermarket | Total | Future | Change | |

| Sales | $3,800M | $250M | $4,050M | $1,580M | -$2,470M |

| GM % | 10% | 65% | 12.5% | 65% | +52.5% |

| GM $ | $380M | $162.5M | $542.5M | $1,027M | +$484.5M |

Let's assume OfficeDepot currently has $3.8 billion in OEM cartridge sales at 10 points of gross margin and $250 million in aftermarket cartridge sales and decided to exit OEM and only offer aftermarket.

Let's assume that action resulted in a loss of 50%, or $1.9 billion of their existing OEM cartridge business. Then, the remaining $1.9 billion was discounted by 30% (per the aftermarket model) so it became $1.33 billion. However, this $1.33 billion is at 65 points of margin, not 10 points.

As shown in the table - that's a new total of just over $1 billion margin dollars, a pick-up of nearly $500MM!

Of course, this is a radical scenario with many implications beyond the risk of losing nearly $2.0 billion in cartridge sales. This strategy would put customer (not just product) retention at serious risk. If ink and toner are 40% of a typical customer's spend on office products, then a $2.0 billion loss in cartridge sales would be likely to compromise $5.0 billion in overall customer sales. That's putting 40% of their North American top line at risk!

Scenario Conclusion:

Much as the management at OfficeDepot may look at the attractive margins on aftermarket ink and toner, and much as they may want to take bold steps forward, I just don't see a successful transition path to the scenario I've described. So, bottom line, this is not a viable path for breaking the cartel and increasing aftermarket share. Unfortunately, Depot is trapped inside the existing cartel arrangement, so I have to rate the likelihood of this path developing as zero out of five.

4. Tier 2 & 3 Resellers emerge, empowered by the Chinese

The OEM's don't have much influence over the strategies and tactics of the Tier-2 distributors and the smaller independent office products resellers. Because they don't have much influence, this group may represent a potential future threat to the OEM's, particularly if they were to combine with the newly emerged Chinese aftermarket manufacturing superpowers. This possibility must be worrisome for the OEM's and may account for specific actions, like HP's massive shake-up of its authorized reseller program between 2012 and 2014. This strategy may have been specifically targeted toward weakening a category of resellers they could not control and that (when sufficiently weakened) they did not believe had strong prospects for competing successfully with them in the future. In other words, despite their actions leading to strong levels of resentment within a large group of resellers, they did not believe this action was going to come back and bite them in the future!

Think for a moment about SGT's acquisition of the global Cartridge World franchise. There are 500 or so franchise locations throughout North America and a similar number scattered in other markets around the globe. This acquisition is a prime example of a Chinese superpower acquiring distribution in order to bypass the current cartel. This is not a franchise focused on the dog-eat-dog world of internet related bottom-feed pricing. This is a franchise focused on its quality, its brand and its physical presence in prominent local markets. This is a franchise focused on the "blue ocean" of OEM conversions, not the "red ocean" of random internet business with high customer churn and razor thin margins.

Think for a moment about OfficeDepot's "store of the future" strategy - this isn't so different to the Cartridge World concept. A smaller, physical presence in local markets with the ability to leverage relationships and minimize customer churn by continuing to deliver a first-class customer experience.

Think for a moment about BestBuy. Everyone was predicting they didn't have a future, they'd become a showroom where you could touch and feel products you were interested in before leaving to go and find the best deal online. Who would have thought BestBuy could successfully adapt and to now be showing promising signs of winning such a major battle against Amazon and other online retailers? What does this developing success story tell us in terms of customers wanting to physically deal with someone as opposed to something? The internet has not eliminated the human desire to interact with real people!

What could all this mean for the smaller independent resellers and their future in the office products and supplies space?

Firstly, the focus on the "red ocean" of random e-commerce initiatives should be curtailed and there must be a new emphasis on doing what OfficeDepot, Staples, Tier-1 independent dealers and a franchise like Cartridge World, are doing. These organizations all appear to believe a strong physical presence in local markets is important to their future business prospects. The Tier-2 dealers need to adopt a similar approach.

It should not be beyond their means to do so. Firstly, they have ready and willing partners to select from in terms of the Chinese superpower manufacturers. Secondly, the Tier-2 distributors of these Chinese products have the import and the logistics expertise to get products quickly and economically to the reseller's customers. In being prepared to leverage these products and capabilities alongside an upgrade of their individual technology platforms, then there's a possibility to have a meaningful impact in the medium to longer term. However, to be successful with this approach will mean developing sufficient trust and confidence in their capabilities that are necessary to satisfy the performance requirements of the "blue ocean" caliber customers currently served by the Tier-1 retailers and resellers.

To schedule a no-obligation consultation with us to learn more about our turnkey digital business transformation service for office products resellers please click on the link below.

Scenario Conclusion:

The development of a sales channel outside of the existing cartel has already started and its future success is likely. For me, the big question is not whether or not this development will succeed, it's more about what the scale of its success will be. If we assume there are 5,000 independent Tier-2 and 3 resellers left in the United States and Canada, and that (for example) Cartridge World makes up 500, or 10% of this number. Is it going to be just 10% that recognize the opportunity to empower themselves for success, or is it going to be 25% or more? Just imagine 1,500 resellers leveraging technology to transform their businesses, just imagine if they each had an average of $1 million in annual sales - that adds up to $1.5 billion in aggregate. Now, that's a potentially significant sales channel development story that would keep the OEM's awake at night!

Because of the strength of the existing cartel and its ability to block the growth of the aftermarket, I believe further development of this independent sales channel, that's outside the control of the cartel, is the only viable path to achieving increased aftermarket share. I rate its longer term likelihood of success at a strong 4 out of 5!

Conclusions:

The important point to understand is that we're entering a new phase in the development of the office products vertical, that change is likely and, as always, there will be winners and losers. For those that are prepared, change will bring opportunity.

For the smaller, local resellers that focus on their value proposition, including developing their ability to compete effectively with the service routinely provided by larger companies, there will be opportunities that can benefit their businesses. However, if instead, they choose to get caught in an online price game with poor quality, potentially infringing products or inadequate information technology systems, then they'll be poorly positioned and will fail to benefit at all.

The aftermarket products are well positioned from a technology perspective, from a cost perspective, and from a competitive perspective. Remember, for example, unlike the OEM's, the aftermarket value chain doesn't have to give up any margin dollars subsidizing hardware development or distribution costs.

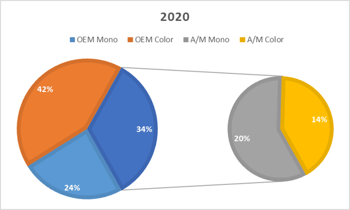

The biggest potential losers, (if the smaller resellers are motivated to step up), stand to be the OEM's and the big-box retailers. A move from 20% to 35% aftermarket share represents an annual shift of over $3.5 billion retail dollars. We know a change of this scale cannot take place through the cartel and, if it's to take place at all, then only the independents can make it so.

Why not check out our free eBook with a comprehensive assessment of the office products industry and the opportunities to develop significant sales growth in a challenging environment despite the ongoing consolidation of a mature industry.